A current issue in both financial and political news is the debt ceiling. In this article, I will cover a brief history about how it came about, what it is, what happens when we reach it, what is going on now in regard to it, and how it may affect you.

Brief History.

The Constitution states that only Congress can authorize the borrowing of money on the credit of the United States. From our country’s founding until 1917, Congress directly issued debt by approving each and every issue on its own, meaning the debt ceiling did not exist in the United States. In order to provide more flexibility to finance the United States’s involvement in World War I, Congress authorized the Second Liberty Bond Act of 1917, which introduced the debt limit.

What is it?

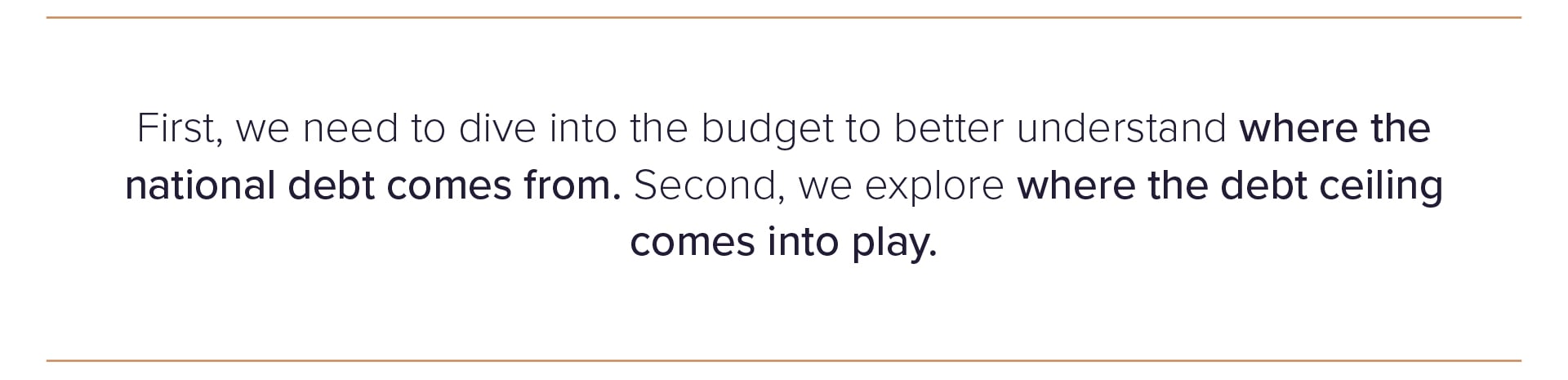

First, we need to dive into the budget to better understand where the national debt comes from. Second, we explore where the debt ceiling comes into play. The budget is made up of mandatory spending, discretionary spending, net interest, and revenues. Mandatory spending includes social security, tax credits, Medicare, Medicaid, and unemployment, among other things.

In 2021, these equated to $4.8 trillion in spending. Discretionary spending includes, but is not limited to, defense, education, transportation, and community development, which came to $1.6T in spending in 2021. Net interest is the government’s interest payments on debt held by the public, offset by interest income the government receives, which resulted in $0.4T in spending in 2021. Adding all of that up, the US had $6.8T in expenses in 2021.

In 2021, these equated to $4.8 trillion in spending. Discretionary spending includes, but is not limited to, defense, education, transportation, and community development, which came to $1.6T in spending in 2021. Net interest is the government’s interest payments on debt held by the public, offset by interest income the government receives, which resulted in $0.4T in spending in 2021. Adding all of that up, the US had $6.8T in expenses in 2021.

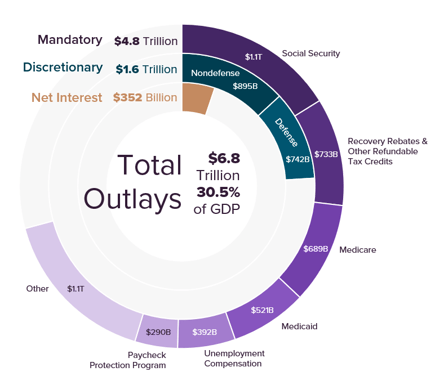

Revenues consist of mostly income tax, payroll tax, corporate income tax, and estate taxes, which added up to $4T in 2021. So, in the fiscal year 2021, we brought in $4T in revenue, but spent $6.8T, leading to a $2.8T deficit.

Revenues consist of mostly income tax, payroll tax, corporate income tax, and estate taxes, which added up to $4T in 2021. So, in the fiscal year 2021, we brought in $4T in revenue, but spent $6.8T, leading to a $2.8T deficit.

The national debt is the total amount of outstanding borrowing by the US Federal government. One way to bridge the gap between spending and revenue is selling treasury bonds, bills, notes and inflation-protected securities. The government has not run a surplus since 2001, meaning every year since 2001 we have operated at a deficit and borrowed money. Going back to 1929, there were only 13 instances of the US running a surplus.

The debt limit, also known as the debt ceiling, is a limit or ceiling imposed by Congress on the amount of national debt that can be outstanding at once. The debt ceiling allows the government to have the ability to create new debt up to a certain dollar amount without Congress having to approve each and every issue like we did prior to 1917. The debt limit as of the time of writing this is roughly $31.4T. The debt ceiling has been raised, extended, or revised 78 times since 1960.

What Happens When We Reach it?

Now that we have some background on the issue, we can start to infer what would happen if we were to reach the debt limit. There are some gimmicky accounting measures that can buy some additional time before breaching the debt limit, but that is outside the scope of this article. If we approach the debt limit again after utilizing those accounting measures, the most obvious thing that would happen is the government would be unable to authorize any new debt, which would force them to make some choices.

The government would have to cut spending, but it is unclear who would be affected and by how much. Would they stop making interest payments and default on our debt? Would we choose to cut defense and education spending? Would we choose to cut social security and unemployment? If we do cut spending, how would we choose who will be affected and who will not be? One thing to keep in mind is that revenue will still be coming in via taxes, so it is not a black and white scenario of us cutting spending down to $0.

Does the Government Shut Down When We Hit the Debt Ceiling?

Government shutdowns are supposed to be a separate issue from the debt ceiling. Government shutdowns occur when annual funding for ongoing federal operations expire. The shutdowns usually occur around the first of October when the Federal fiscal year begins. The reason the debt ceiling and government shutdowns are mentioned together is because the debt ceiling can be used as a political bargaining chip in negotiations when setting the budget.

For example, in 1995, Republican members of Congress threatened to refuse to allow an increase in the debt ceiling unless there was also an increase in government spending cuts. Bill Clinton refused to make the spending cuts, so no budget or continuing resolution was passed, which led to a government shutdown.

What is Happening Now?

On January 19, 2023, US Treasury Secretary Janet Yellen told Congress that the US reached the debt ceiling. We are currently utilizing the special accounting measures mentioned previously to prevent us from breaching the debt ceiling. The government is likely to exhaust those measures and run out of cash on hand around June of this year according to the latest estimates.

Similar to 1995, President Biden wants to increase the debt ceiling without any cuts in spending. The House of Representatives, however, wants to cut some of the mandatory spending out of the budget. So now we are in a standoff with the debt ceiling being used as a pawn where the House will not pass an increase to the debt ceiling until there is an agreed-upon spending cut. Because the President doesn't want to cut spending, there is now more finger pointing than actual negotiating.

Potential Unconventional Solutions

Many people, including Janet Yellen, have supported legislation to abolish the debt limit as recently as January 2023, which President Biden has ruled out. This idea has been floating around for over a decade with other supporters stating that the debt ceiling leads to a high level of uncertainty and creates worse fiscal outcomes in its current state, although this wasn’t always the case. We are one of two countries along with Denmark that has a debt limit set in absolute terms of a hard dollar amount. Poland, Kenya, Malaysia, Namibia, and Pakistan are the only other five countries with a debt limit. These five countries use a relative value amount as a percentage of GDP, as opposed to a hard dollar amount. Every other government in the world assumes that if spending is legally authorized, then the funds will be made available through taxes or borrowing.

Some people have said, including Nobel laureate Paul Krugman, a simple solution to the problem would be minting a platinum $1T coin. This is because the US Mint is authorized to produce platinum coins without any restrictions in regard to the number of coins produced or their face value. They would mint a coin, distribute it to the federal reserve, who would then deposit it in the US Treasury General Fund. The coin would be kept in a vault and used to pay down the national debt, allowing us to be under the debt ceiling. In turn, the government could then continue to issue more debt to continue spending. Back in 2013, this idea was shot down by the US Treasury and Federal Reserve officials themselves. Janet Yellen has also recently called this “solution” a gimmick that should not be taken seriously as it would undermine confidence in the US economy, and the US’s ability to pay its debts around the world. It is also important to consider the inflationary effects that would arise from introducing $1T coin out of nowhere.

How Might this Affect You?

As an investor, your bonds may see some price fluctuation in the short term. Under normal market conditions, you may expect to see an upward sloping yield curve, meaning that as you increase the length of the bond, the yield you receive will be higher. This was the case at the start of the year with respect to short-term treasury rates, as the 6-month interest rate was greater than the 3-month, which was greater than the 1-month. However, that is currently not the case. The yield on a one-month treasury security is 5.50%, a three-month is 5.30% and a six-month is 5.15%. This shows that throughout the summer when the US is expecting to run into an issue with the debt ceiling, there may be an increased risk premium present due to the short-term uncertainty around the situation. We have seen the cost to protect yourself from the US defaulting on its debt increase nearly 10x since the beginning of the year. For example, at the beginning of the year it would have cost you $1.80 to buy insurance on $1,000 par value one year US government bond. As of the end of April, it now costs $17.90 to buy that same insurance on the same maturity bond.

Another thing to keep in mind is net interest in the budget has been relatively stable given the low-rate environment we have been in for the last decade. As a taxpayer, that means less interest cost to you and your loved ones.

As we enter a rising-rate environment to try to ease inflation, the cost of increased interest expense may be an issue moving forward. Approaching the debt limit may lead to a downgrade in the credit rating of US debt, which can lead to having higher interest rates as well. The potential for a downgrade is due to the uncertainty surrounding the spending prioritization should the debt limit be reached. If the government is forced to limit spending to the amount of tax revenue received, will bondholders be one of those groups who do not receive the full amount promised? If a downgrade were to occur, this could increase the cost of future borrowings. As a taxpayer, this could mean more cost to you and your loved ones to offset the increased interest expense.

Disclosure

© 2023 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®