What a week it has been. The global stock market hit correction levels, losing 12% in the US, 7% in foreign developed, and 6% in the emerging markets. Heightened fears of the coronavirus outbreak turning into a global pandemic pushed some investors to run for the exits, redeploying their proceeds into cash and bonds, pushing the benchmark 10-Year Treasury yield down to an intraday all-time low of 1.17%.

KEY POINTS:

- Cases of the coronavirus have spread to other countries, but positive news is also emerging from China

- Volatility sharply increased and index levels declined the week of February 24

- Market corrections are inevitable and generally not time for reactions or sell-offs for long-term investors

- Speak with your adviser if you feel uncomfortable or are considering portfolio changes

(Information as of February 28, 2020)

How we arrived here.

The heightened fear came as news broke of dozens of new cases popping up outside of China; in the US, Sweden, Iran, Italy, and the Canary Islands. It’s important to note that there is some positive news in China, where workers are returning to their campuses, preparing to bring their production back on-line. The number of fully recovered patients is also increasing, while the mortality rate remains much lower outside of China, at 1.43%.

|

|

China |

Outside of China |

|

Cases |

78,497 |

3,903 |

|

Deaths |

2,744 |

56 |

|

Mortality rate |

3.5% |

1.43% |

|

|

As of February 27, 2020 |

|

Impact on the markets.

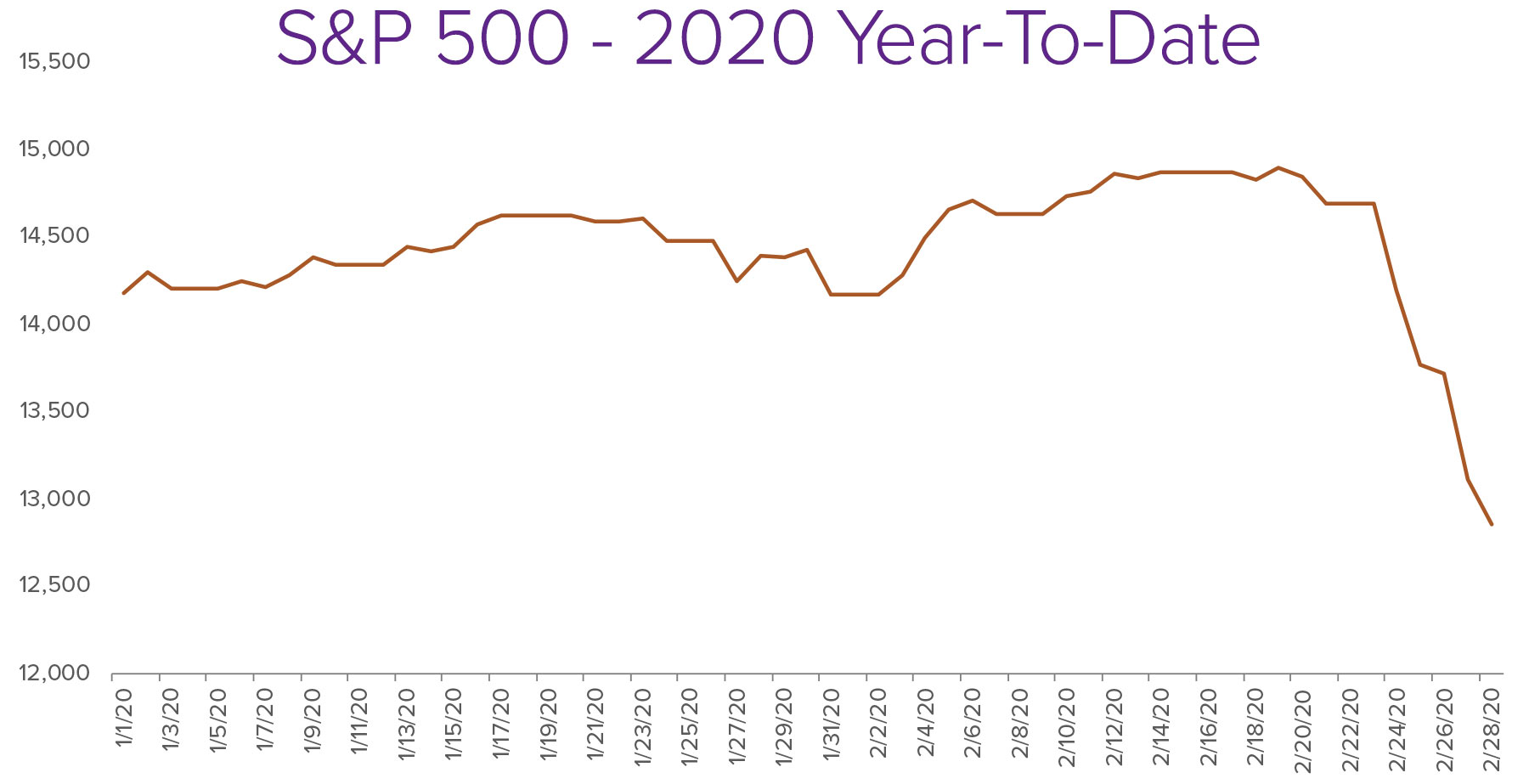

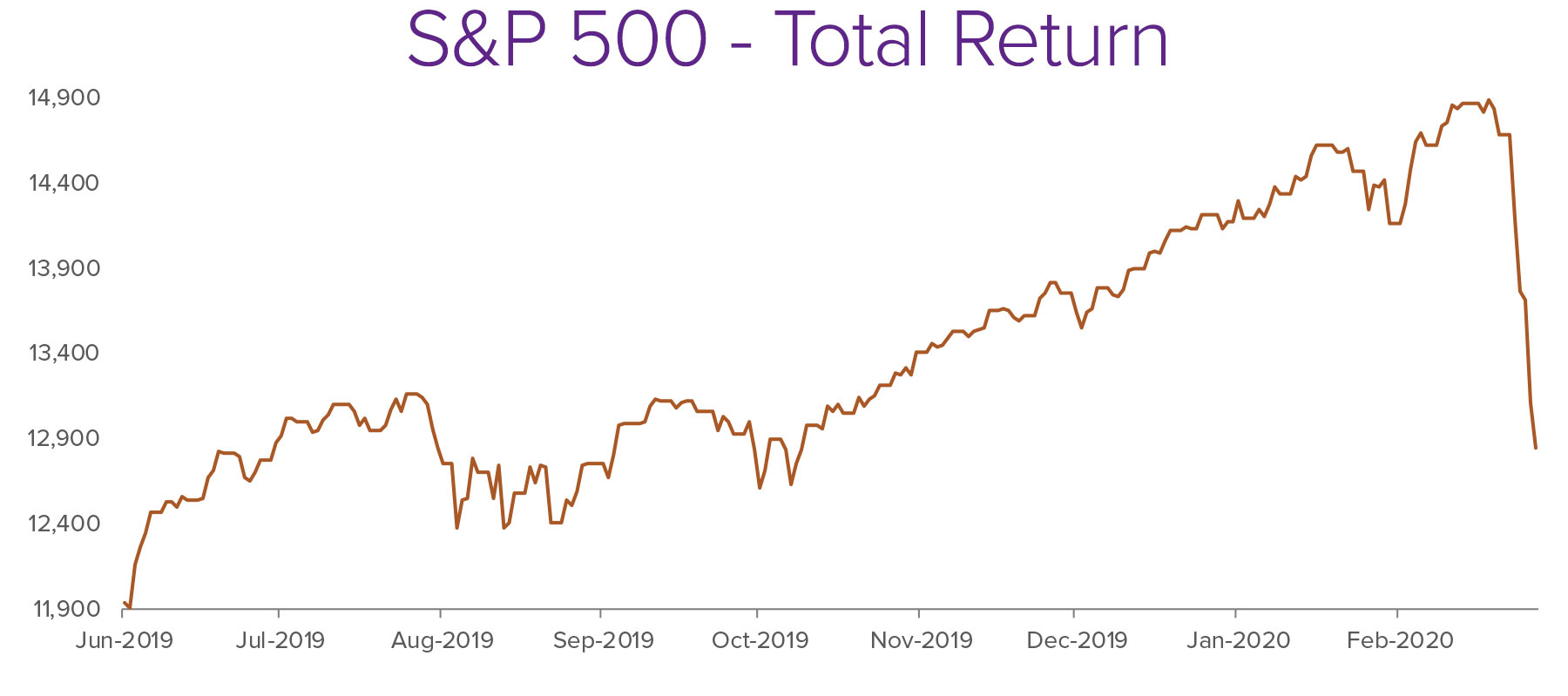

When news of coronavirus initially broke last month, we saw a dramatic reaction, followed by resiliency in the market pushing us to all-time highs in the US last Wednesday, February 21. Concerns faded as it appeared the extent of the global impact would be limited to a month or two of slowing economic growth in China and a mild disruption in global supply chains.

The concern today is that the consumer slowdown may spread to less-affected areas as fear keeps people in their homes, away from traveling and spending. We’ve seen a number of travel restrictions (UAE/Iran) and travel suggestions (US). Major global events have also been cancelled or postponed, including the Chinese Communist Party’s “Two Sessions” Parliamentary gathering, the Mobile World Congress in Barcelona, and Facebook’s Marketing Summit in San Francisco. Fears continue to rise that the Tokyo Olympic Games, scheduled to begin in July, may also be affected or cancelled.

Putting it in perspective.

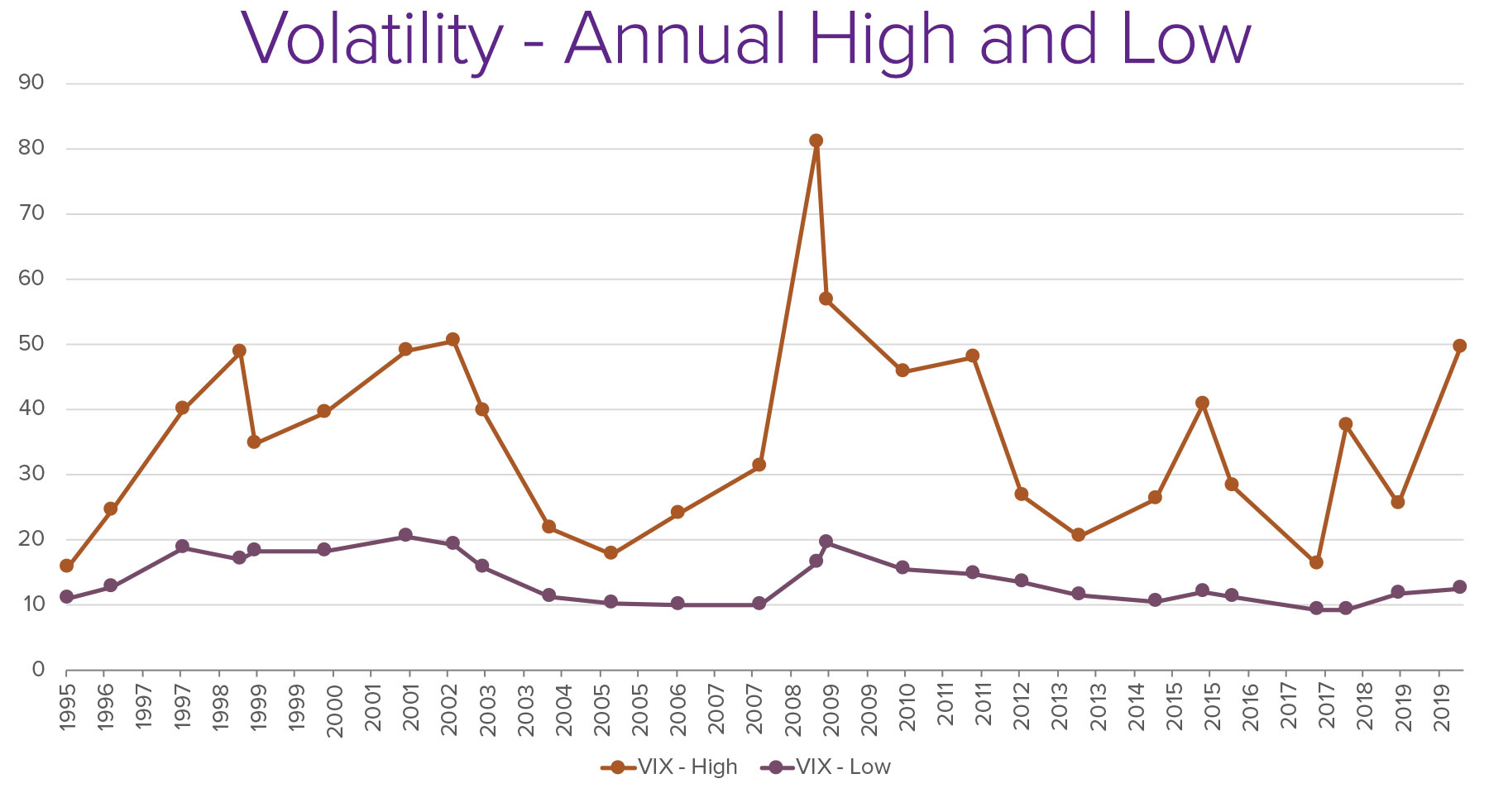

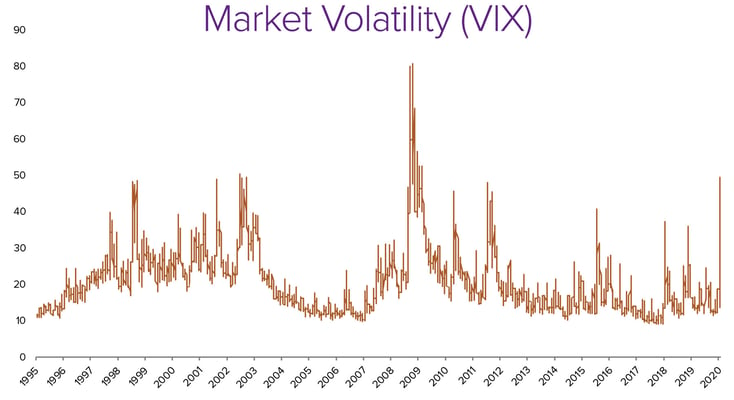

The headlines and heightened volatility are certainly uncomfortable for us both as citizens and investors. On Friday, we saw the volatility index (VIX) spike to 49—a level we haven’t seen since Black Monday on August 8, 2011, when Standard & Poor’s cut the credit rating of the United States to AA.

The spread between the complacent level of volatility we were experiencing just six weeks ago, 12, and our current peak of 49 occurred very quickly—potentially increasing the impact on investors’ psyches. Understandably, that VIX spread is as high as it was in the early days of 2009, the tail end of the worst market in history.

While we may feel a great amount of unease and anxiety over the movements, we must keep in mind that this has brought us back to index levels we saw eight months ago in June 2019. In regard to the level of volatility, we’ve experienced these several times over the past decade, and are still below the peaks of the financial crisis in 2008 where the index crested to 80. We certainly don’t know if this is going to be the inflection point. However, the willingness of the global community to come together to fund testing and treatment of the virus, as well as the central banks of the world all willing to use their tools to help combat its effects, are encouraging for the future.

What can I do?

It’s important for investors to maintain their long-term view, realizing we’ve been through markets and weeks like this before. It is tempting to pull the trigger and react. However, that reaction, if not timed exactly right, may be very costly to a family.

This market is a reminder of the cost of investing in risky assets, after a greatly positive but relatively complacent decade in the markets. We suggest viewing this as an illiquidity event. For wealthy families, it’s not time to start accessing capital from your depressed risky assets. Instead, if capital is needed for spending and consumption, sell some of the assets you own that have maintained or appreciated during this time, like core bonds, cash, and alternatives.

Should conditions continue to deteriorate, it may be time to trigger a rebalance of the portfolio or deploy some cash that has been waiting on the sidelines for a buying opportunity. It may also be an opportunity for tax swaps, which, when executed well, will keep the portfolio in the market for a recovery while capturing a tax asset to offset future gains.

If you do become impatient and want to take some risk off the table, it’s important to be mindful of capital gains exposure. We’ve had an unprecedented decade of stock market returns in the US, leaving many equity positions with large gains. Investors may also want to keep their active management exposure where investment managers can select better companies that should hold up better in a downturn, and recover faster as fear subsides.

As mentioned early, this is not only a concerning financial situation but also a public health one. So, what should you say to your friends and family who keep sending you coronavirus doomsday texts? Based on the latest CDC recommendations, feel free to copy and paste the following as a reply:

Hi! I know there are a lot of people saying different things about the coronavirus right now, but I’m actually not that worried, and I don’t think you need to be, either! The CDC says that, for most people, the coronavirus wouldn’t be much more intense than a standard respiratory infection, and the preventative guidelines are pretty similar to the ones you'd follow to keep from getting the flu. They recommend lots of hand-washing, avoiding contact with people who seem sick, and keeping your hands away from your eyes, nose, and mouth. Sounds like what you always say!

Stay informed and in touch.

Hopefully, this post helps ease some of the anxiety you may be feeling over the markets, as we place the movement in perspective, keeping our eyes on the long-term time horizon. As always, it’s important to talk with your advisers if you’re feeling uncomfortable. If nervousness is driving you to action, we can work together to find the right solution for your family now or in the future.

Disclosure

© 2020 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®