A part of most investment portfolios, bonds have been colloquially labeled as low-risk, boring investments while stocks and other investment vehicles tend to attract more headlines. Unfortunately, poor bond performance driven by high interest rates in 2022 (illustrated by a -13.1% return in the Bloomberg Aggregate Bond Index) and the recent closures of banking institutions including Silicon Valley Bank (SVB) have brought bond investing into the spotlight. The once reliable asset class has now come into question as investors are more closely scrutinizing their portfolios in response to recent economic conditions.

Stock investing vs. bond investing.

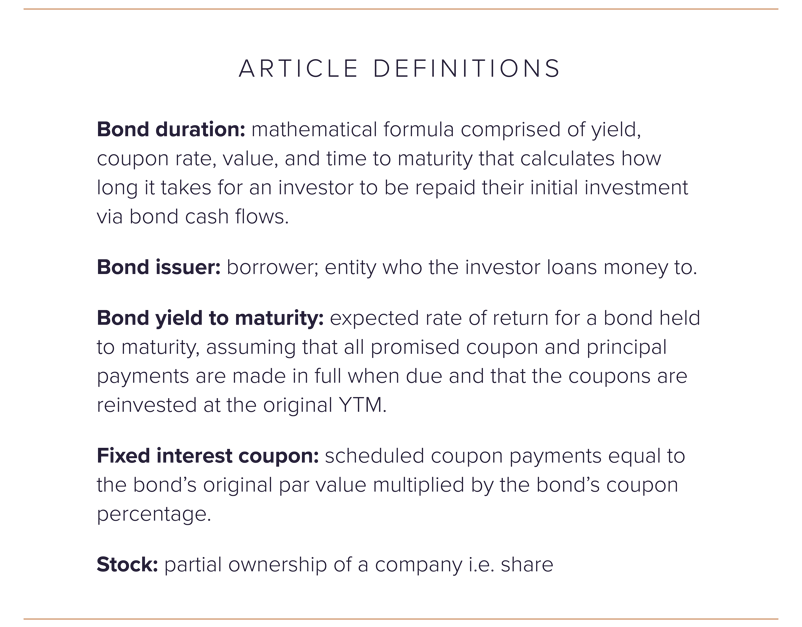

The distinction between bond investing and stock (or “equity”) investing is imperative to understand how bonds work and their role in a portfolio. When investing in stocks, an investor buys a small portion (“share”) of a company with the expectation that the company will earn future profits and the share price will subsequently increase in value over time. A stock’s value is theoretically determined by the present value of the expected future cash flows of the company per share. In some cases, a company may also periodically pay a portion of their earnings as dividends, like an interest rate. However, stock investing can be volatile and riskier than other investments due to the significant impacts investor sentiment and economic conditions can have on a stock’s value.

Contrary to stocks, bond investing can be simplified as loaning money to a company or government entity for a set time period in return for consistent, scheduled fixed interest coupon payments (“fixed income”) until the bond matures and the initial investment is returned in whole. Bonds are not as sensitive to the same risks stocks face and offer diversification in an investor’s portfolio.

Understanding bond returns.

The fundamental purpose of bond investing is to receive fixed income in exchange for loaning money to another entity. For example, an investor buys a $1,000 10-year bond with a 5% coupon rate. The issuer of the bond – the entity an investor loans money to – pays the investor $50 every year until the bond reaches its 10-year maturity, and the investor gets their original $1,000 back. A bond’s yield to maturity is the rate of return it generates over its life and is subject to change as a bond’s value fluctuates in the open bond market. The intent of bond investing is to earn a rate of return, or yield, above the rate of inflation. If a bond’s yield is less than inflation, the investor is losing purchasing power and has a negative real (adjusted for inflation) yield.

Bonds typically are less risky than stocks. If a company goes into bankruptcy or liquidation, corporate bondholders are higher on the hierarchy of being paid whereas stockholders are paid last, if at all. Further, municipal or foreign sovereign bonds, while not backed by collateral, are backed by the taxing authority of the respective government. Some bonds are more subject to default or credit risk. These bonds, called high yield debt, pay a higher interest coupon rate to compensate investors for taking on a greater risk of not being paid back in the event the issuer defaults.

Interest rate risk and its significance.

Another primary risk with bond investing is interest rate risk – the key driver behind historically poor 2022 bond performance and the closure of SVB. Bond prices and interest rates have an inverse relationship; as interest rates rise, previously purchased bonds’ values are susceptive to dropping. For example, an investor buys a 5-year $1,000 bond with a 5% coupon rate in 2021. In 2022, interest rates rise and a similar 5-year $1,000 bond on the market would hypothetically have a higher coupon rate and be more valuable than the bond purchased in 2021. Therefore, if the investor wanted to sell their bond bought in 2021 on the open market, they would need to sell it at a discount to account for their relatively lower coupon rate. Conversely, as interest rates decrease, previously bought bonds with a relatively higher coupon rate tend to sell at a premium.

A bond value’s sensitivity to interest rate movement is dependent on the bond’s duration. Bond duration is not equivalent to maturity, but is a mathematical formula comprised of yield, coupon rate, value, and time to maturity that calculates how long it takes for an investor to be repaid their initial investment. Bond durations are also measured in years, but are shorter than time to maturity. If interest rates rise just 1%, a bond with a 5-year duration will likely decrease 5% in value. The longer the duration a bond has, the more sensitive it is to interest rate risk.

Interest rate risk and recent headlines.

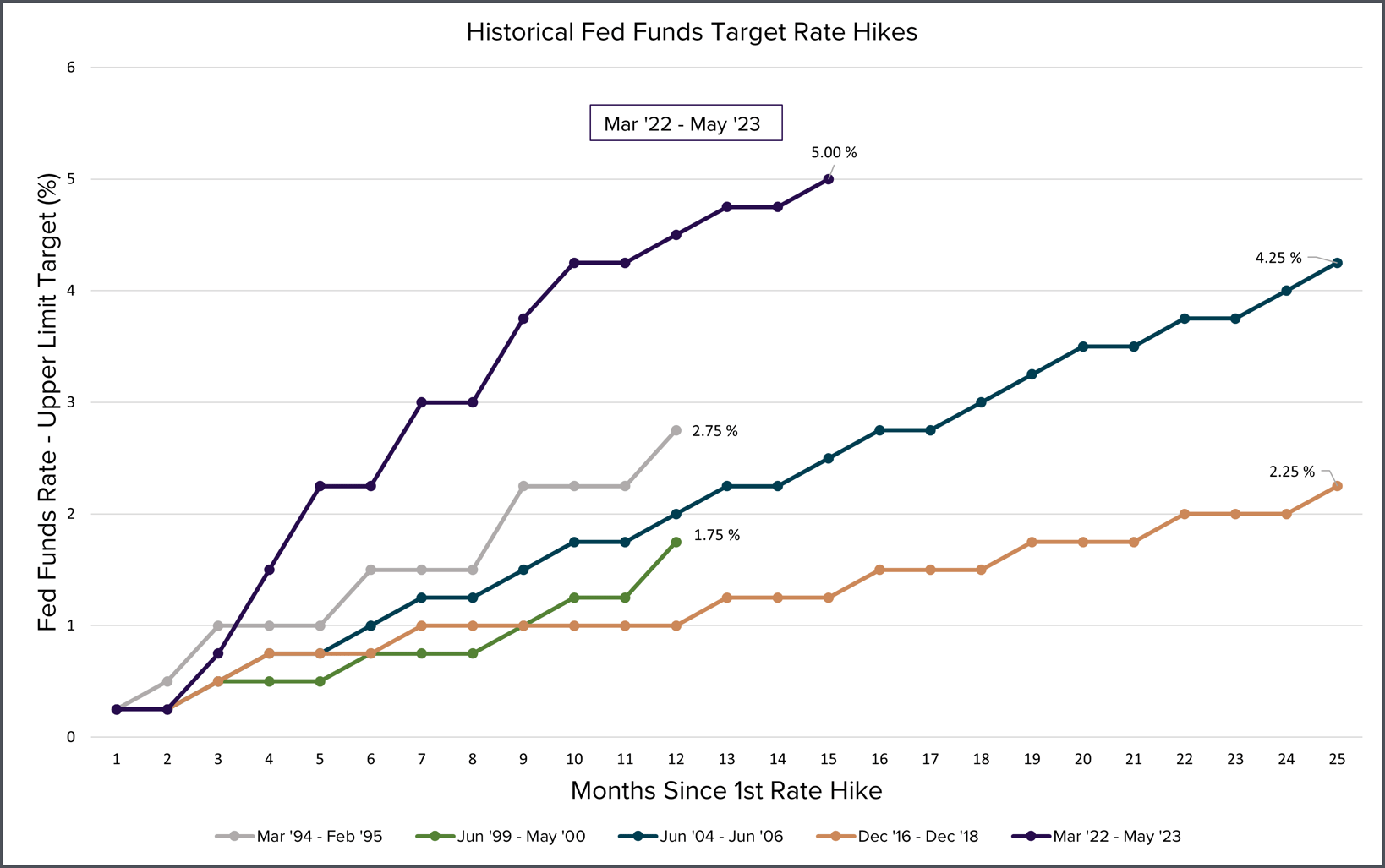

In contrast to the low interest rate environment and low inflation experienced in the last decade, the stimulus aided economy and post-pandemic consumer demand increase drove inflation over 9% at its peak in 2022. In an effort to cool high inflation and slow the economy, the Federal Reserve implemented ten interest rate hikes each ranging from .25% to .75% in the last 14 months. From March 2022 to today, the Federal Funds Rate Upper Target has rapidly and dramatically risen 5.00% - a 2000% increase in a little over a year. Consequently, interest rate risk caused existing bonds’ values to plummet leading to a historically poor 2022 bond performance. At its worst point in 2022, the overall bond market bottomed out at -17% return and ended the year over -13% return.

Many individual investors and institutions felt the burdens of the interest rate hikes, exemplified by the collapse of Silicon Valley Bank. The bank’s investment portfolio took a dive as its longer duration bonds took massive losses. In concert with liquidity issues, uninsured bank deposits and undiversified customer bases, interest rate risk forced the bank to close its doors. The bond market has slightly rebounded in 2023, yet the tank in 2022 may continue to have lasting effects.

Bond investing outlook.

Despite recent turmoil in the bond market, this asset class remains a critical part of investment portfolios for investors. Risks arise with any investment, but the effects of interest rate risk on bond performance over the last year may be deemed unusual considering the unprecedented, unexpected rate hikes instituted by the Federal Reserve. Over time, bond prices will likely increase toward their face values allowing bond investors to potentially recoup some of the unrealized bond losses seen in the past year.

With the uncertainty of the Federal Reserve’s direction in future interest rate manipulations, it is important to be cautious of risks associated with bonds and other investments. A properly constructed portfolio utilizing appropriate bond types and duration is necessary to mitigate risks associated with bond investing. Please consult with your Sanderson Wealth adviser to help you manage this volatility.

Disclosure

This publication contains general information that is not suitable for everyone. All material presented is compiled from sources believed to be reliable. Accuracy, however, cannot be guaranteed. Further, the information contained herein should not be construed as personalized investment advice. There is no guarantee that the views and opinions expressed in this publication will come to pass. Past performance may not be indicative of future results. All investments contain risk and may lose value. © June 2023 JSG

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®