A Tale of 2 Halves.

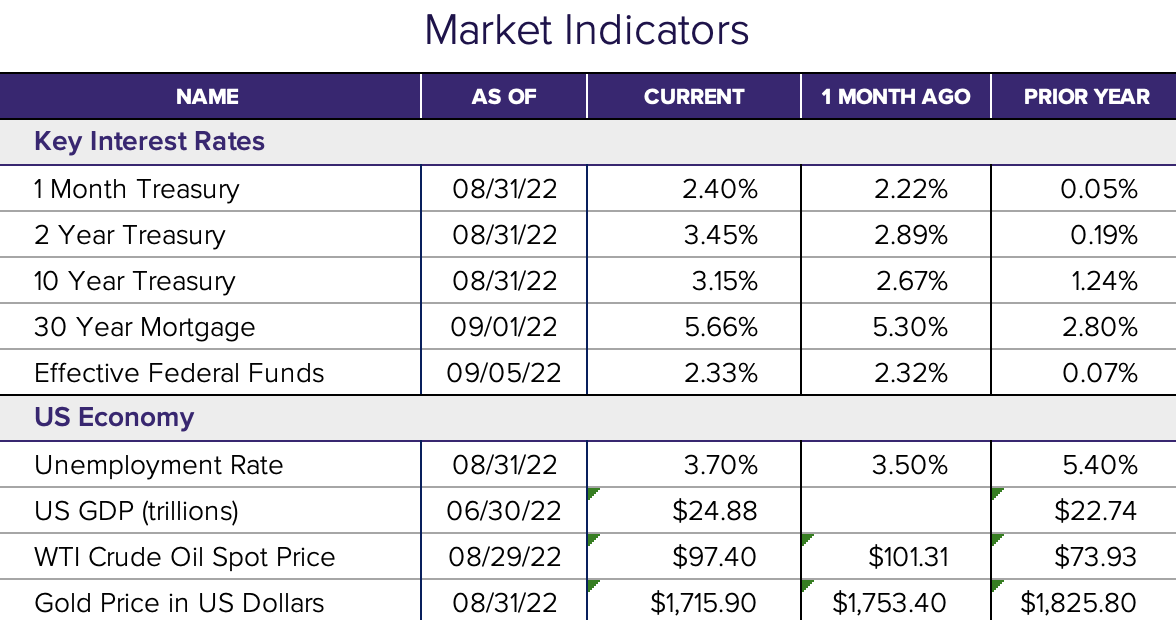

The summer stock market rally continued into the first half of August but came to an abrupt end only to finish the month in the red. Investors' appetite for risk was high on hopes of a peak in inflation and a potential Fed pivot on rate hikes. The dramatic reversal in sentiment and market performance occurred as investors digested Fed Chair Jerome Powell’s speech during the annual Jackson Hole Economic Symposium.

During his speech, Powell reiterated the Fed’s commitment to beating inflation and continued plan to raise rates even in a recessionary environment, acknowledging that it would inflict “some pain,” which would be one of the “unfortunate costs of reducing inflation.”

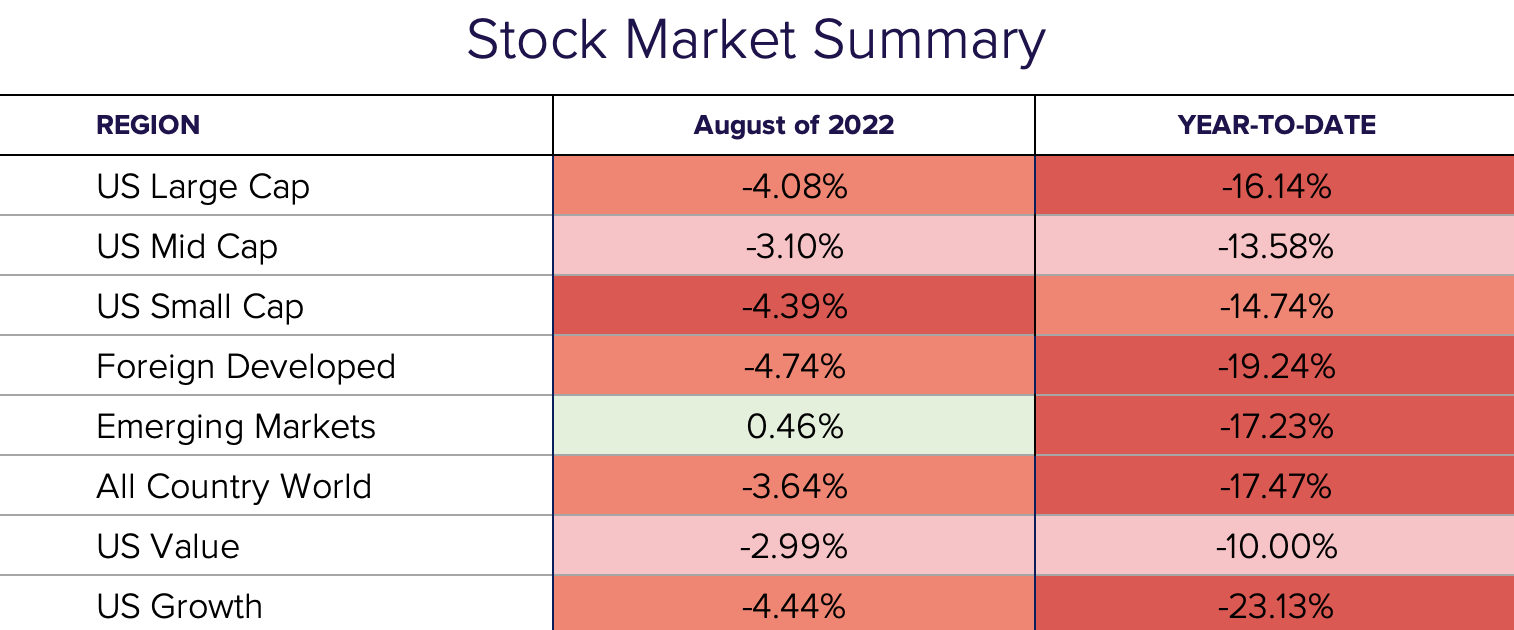

Markets.

The summer rally peaked a full 2 months from the mid-June lows. The S&P was +4.7% on August 16th before finishing the month down -4.2%. Growth stocks and Foreign Developed stocks led the way down -4.4% and -4.7%, respectively. Emerging Market stocks held up significantly better, finishing up +.46%. Despite the negative month, stocks are still trading above the mid-June levels.

Outlook.

Given the Fed’s hawkish stance on continued rate hikes, expectations are now for an additional .75% increase in the Fed funds rate for the September 21st meeting. Heading into a historically weak month for stocks, it will be important to see the market stay above those mid-June lows.

Disclosure

© 2022 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®