Stocks advanced in April thanks to stronger-than-expected earnings reports from mega-cap tech companies. Bonds tell a less rosy story. A preliminary GDP report, showing signs of a slowing economy and additional inflation data points, led to an additional 0.25% rate hike by the Fed at their May meeting.

Stock Market Strength

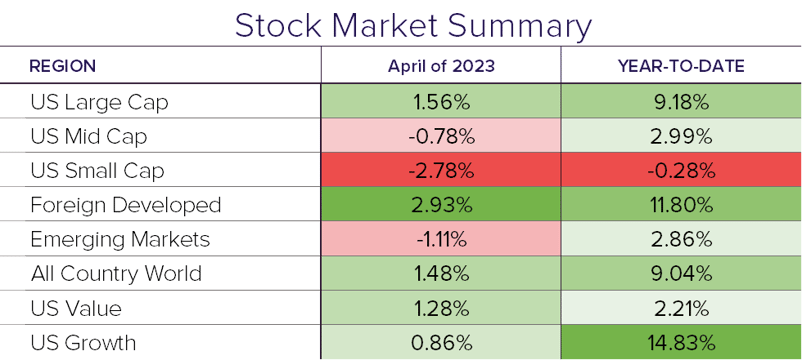

Half of the companies in the S&P 500 index, including some of the largest tech stocks, released earnings thus far. Over 80% of them surprised to the upside driving the US large cap index 1.56% higher. Mid and small cap stocks were overshadowed by their larger counterparts and were down -0.78% and -2.78%, respectively.

Meanwhile, First Republic bank grabbed headlines as depositors continued to flee in mass, ultimately leading to the third failure in this recent regional banking crisis. JP Morgan emerged as the buyer, and those depositors should now have full access to their deposits as JP Morgan customers.

Elsewhere, international markets were mixed. Foreign developed stocks were up 2.93% in April while emerging markets were the laggard for the month, down -1.11%.

Bond Market Morose

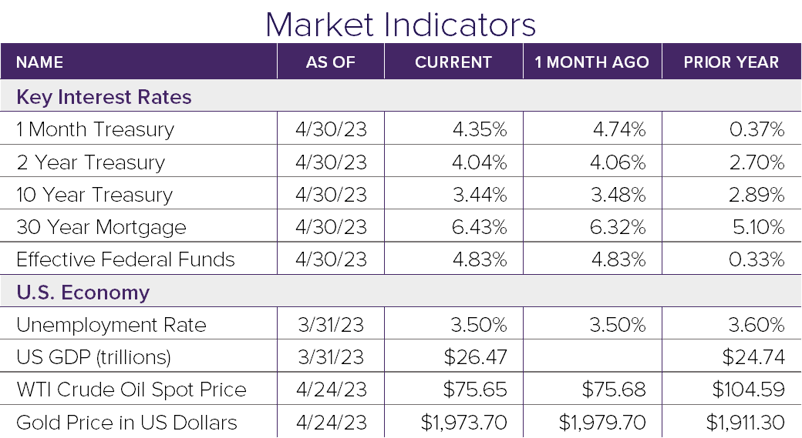

The recent optimism in stocks, particularly growth stocks, seem to differ in opinion with the bond market. Treasury yields continued their advance with several shorter-term maturities breaking above 5% and their corresponding prices dropping because of the inverse relationship between yields and prices. The 10-year treasury rate finished the month at 3.44%, marking the lowest point on the yield curve. The significance lies in the difference between the 10-year and 3-month rate, known as the spread. It is currently the most inverted it has ever been at -166 bps (1 basis point = 0.01%.). Every recession since 1970 has been preceded by at least one yield spread inverting.

The Economy

The most recent GDP report showed the economy grew just 1.1% YOY indicating a slowdown in overall growth. A modest drop in core Personal Consumption Expenditures (PCE) price index – the Fed’s preferred inflation gauge – showed that inflation may be moderating but remains stubbornly high. The latest measurement of the employment cost index, a broad measure of labor costs, accelerated 1.2%.

Despite the lower-than-expected GDP print, investors and the Fed were focused on the strong inflation data with the 25 bps rate hike fully priced into the market. Looking ahead, we will be watching the numbers closely for economic clues about the upcoming widely predicted recession. It seems it will take an even bigger slowdown in the economy to test the stock market optimism.

Disclosure

© 2023 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®