April 2022 was one of the toughest months in years. Investors faced a multitude of headwinds including tightening monetary policy, rising interest rates, 40-year inflation highs, more COVID lockdowns in China, and the ongoing war in Ukraine.

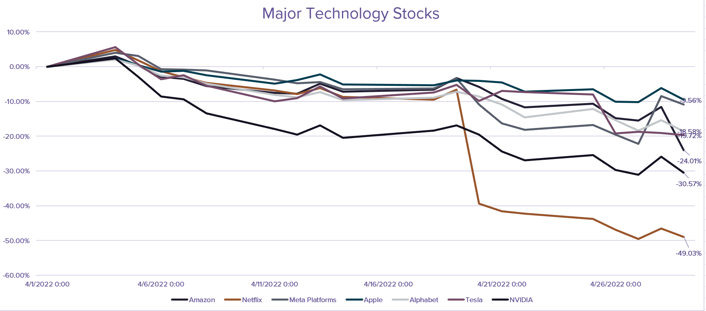

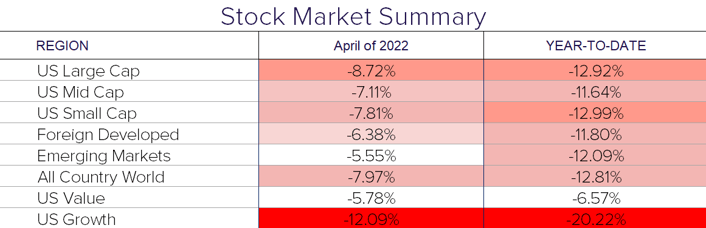

Global stocks retreated 8%. US Value and Emerging Markets held up better only giving up 5.8% and 5.6% respectively. Technology stocks led the April decline, with the tech heavy Nasdaq index giving up 13.3% this month. The chart below shows some of the largest and most popular technology and growth stocks:

Global growth concerns.

The US dollar hit its highest level in 20 years as global investors flock to higher interest rate US debt due to growth concerns. The US economy—as measured by GDP—shrank for the first time since the pandemic, contracting 1.4% in the first quarter of 2022. Further digesting the data, the largest detractor was the trade imbalance as the stronger dollar provides opportunity to import more goods at lower prices. Also dragging that number lower was a slower build in inventories as the world deals with supply chain constraints. On a positive note, business and consumer spending remain high indicating some underlying strength.

Eye on the labor market.

The labor market will be key to watch in the coming months. The current labor market has a very significant supply and demand imbalance. There are almost 2 job openings for every unemployed person. Businesses are facing rapidly rising wages and an inability to fill openings with skilled workers, which only continues to add to the current inflation and supply chain problems.

Fed balancing act.

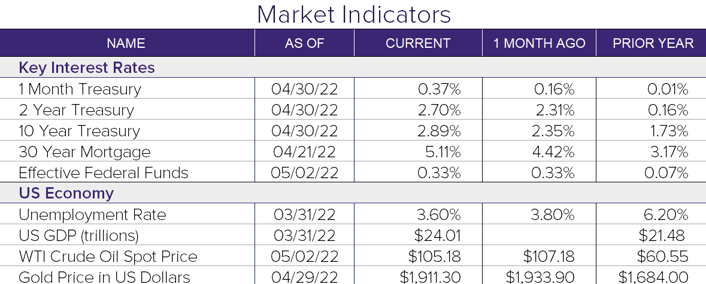

Slowing economic growth and high inflation have the Fed caught in a precarious balancing act. In order to maintain their credibility with investors, they need to get inflation under control. Typically, that is done by monetary tightening via rate hikes and/or decreasing their balance sheet. The problem is that monetary tightening naturally slows down the economy. We already have a slowing economy and overreaction could potentially tip the scales toward a recession.

On May 4th, a 0.50% rate hike was announced at the Federal Open Market Committee meeting, a move not seen since 2000. They also announced a plan to systematically reduce their balance sheet. Jerome Powell clearly acknowledged inflation and its effect on Americans. He also ruled out the possibility of future 0.75% hikes. The lack of any unexpected surprises led to a positive initial reaction by the markets as stocks finished the day 3% higher and the 10-year yield finished lower.

Rising rates on the American consumer.

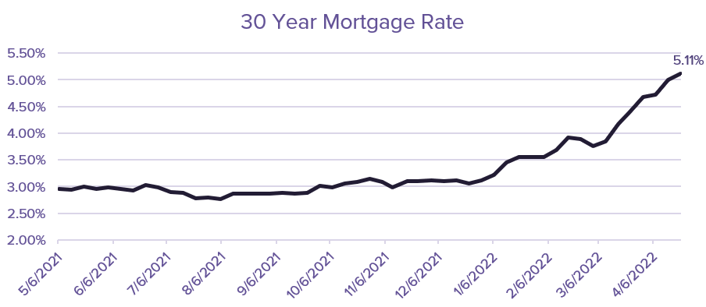

The American consumer is dealing with a lot of change. Rapidly rising prices of goods and services have no doubt been felt in their bank accounts. There is a catch 22 as the Fed works on stabilizing prices. Increasing rates may moderate inflation which is ultimately best for the overall economy, but it also has some second-rate effects. For example, financing a home purchase has gone up significantly. The 30-year mortgage rate is now over 5%—the first time in over 10 years. This is up from 3% a year ago.

So what are we doing?

Despite all the uncertainty and fear that has been floating around the markets in the month of April, our portfolio strategy remains in place. Maintaining appropriate target allocations to core bonds, global equities, and non-traditional assets have proved successful in navigating all market conditions. Non-traditional assets—with their low correlation to traditional risk assets—have provided an important anchor in portfolios during times of volatility. Sanderson will continue to expand its offerings and allocations to non-traditional assets in light of the current macroeconomic environment.

Disclosure

© 2022 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®